Everything about Pvm Accounting

Everything about Pvm Accounting

Blog Article

Pvm Accounting for Beginners

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.The Facts About Pvm Accounting RevealedOur Pvm Accounting DiariesThe Only Guide for Pvm AccountingFacts About Pvm Accounting UncoveredThings about Pvm Accounting

Make certain that the audit procedure abides with the regulation. Apply called for building and construction accounting standards and procedures to the recording and coverage of building and construction task.Communicate with different financing firms (i.e. Title Company, Escrow Business) relating to the pay application procedure and requirements needed for repayment. Assist with applying and keeping inner economic controls and treatments.

The above statements are intended to describe the general nature and level of job being executed by people designated to this category. They are not to be construed as an exhaustive listing of obligations, tasks, and abilities called for. Personnel might be needed to perform tasks beyond their regular obligations every now and then, as needed.

The Basic Principles Of Pvm Accounting

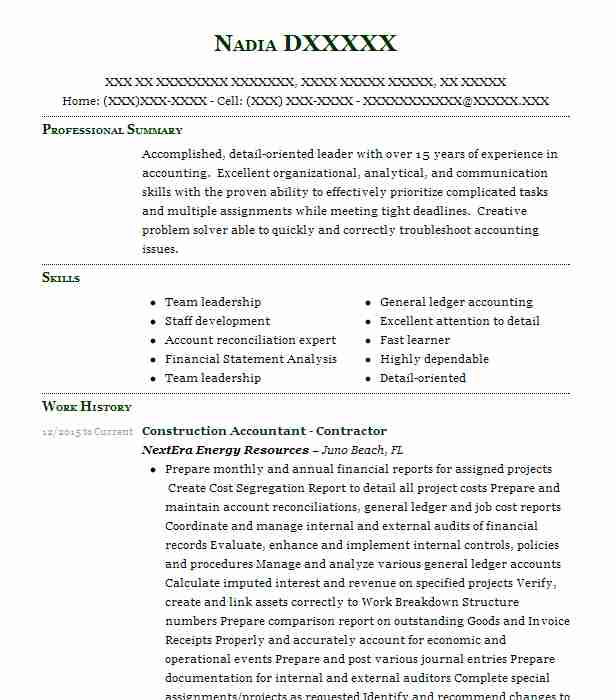

You will certainly assist sustain the Accel team to guarantee delivery of successful on time, on budget plan, projects. Accel is looking for a Building Accounting professional for the Chicago Office. The Building and construction Accountant carries out a range of accounting, insurance policy compliance, and job management. Functions both independently and within details departments to preserve monetary records and make sure that all documents are maintained current.

Principal tasks consist of, yet are not restricted to, dealing with all accounting functions of the business in a timely and accurate manner and providing records and timetables to the company's CPA Company in the prep work of all monetary statements. Guarantees that all bookkeeping procedures and functions are taken care of properly. In charge of all financial documents, payroll, banking and daily procedure of the audit feature.

Prepares bi-weekly test equilibrium reports. Functions with Task Managers to prepare and upload all monthly billings. Procedures and problems all accounts payable and subcontractor settlements. Produces month-to-month recaps for Employees Compensation and General Liability insurance policy costs. Creates regular monthly Work Cost to Date records and functioning with PMs to fix up with Task Supervisors' budget plans for each job.

Some Known Questions About Pvm Accounting.

Effectiveness in Sage 300 Building and Property (previously Sage Timberline Office) and Procore building monitoring software a plus. https://pvmaccount1ng.creator-spring.com. Have to additionally be efficient in various other computer system software program systems for the prep work of records, spread sheets and other accountancy analysis that may be required by management. construction accounting. Have to have solid organizational skills and capacity to focus on

They are the monetary custodians who ensure that building and construction projects stay on budget plan, conform with tax regulations, and keep monetary transparency. Building accountants are not simply number crunchers; they are calculated partners in the building and construction process. Their primary duty is to handle the financial elements of construction tasks, making certain that sources are designated efficiently and economic threats are decreased.

All About Pvm Accounting

By keeping a limited grasp on project finances, accountants help protect against overspending and economic setbacks. Budgeting he said is a foundation of successful building jobs, and building and construction accounting professionals are instrumental in this respect.

Building and construction accountants are fluent in these policies and make certain that the job conforms with all tax requirements. To succeed in the duty of a building and construction accounting professional, people require a strong educational foundation in accounting and finance.

In addition, certifications such as Certified Public Accountant (CPA) or Qualified Building Sector Financial Specialist (CCIFP) are extremely concerned in the industry. Functioning as an accountant in the construction sector includes an unique collection of challenges. Building and construction jobs often entail tight target dates, altering regulations, and unanticipated expenses. Accounting professionals have to adapt promptly to these difficulties to maintain the project's monetary wellness intact.

Getting The Pvm Accounting To Work

Expert qualifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate proficiency in building and construction bookkeeping. Ans: Building and construction accountants develop and keep track of spending plans, identifying cost-saving possibilities and making sure that the task stays within spending plan. They also track costs and projection economic requirements to stop overspending. Ans: Yes, construction accountants handle tax obligation conformity for construction jobs.

Introduction to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms need to make tough options amongst lots of monetary choices, like bidding process on one task over one more, selecting funding for products or devices, or establishing a task's profit margin. Building is a notoriously unpredictable industry with a high failing price, sluggish time to repayment, and irregular cash circulation.

Production entails repeated procedures with easily identifiable prices. Production calls for different procedures, products, and devices with varying expenses. Each project takes area in a new area with varying website conditions and distinct obstacles.

More About Pvm Accounting

Lasting relationships with vendors ease negotiations and improve efficiency. Inconsistent. Frequent usage of various specialty specialists and distributors influences effectiveness and capital. No retainage. Payment gets here completely or with regular payments for the complete agreement amount. Retainage. Some section of settlement may be withheld till task completion even when the service provider's job is ended up.

Routine production and short-term contracts result in workable capital cycles. Irregular. Retainage, slow payments, and high upfront costs lead to long, uneven capital cycles - construction accounting. While traditional manufacturers have the benefit of regulated atmospheres and optimized production procedures, building business must constantly adjust to every new task. Even somewhat repeatable projects call for adjustments as a result of site conditions and various other factors.

Report this page